Clients We Work With

Financial Planning for a

High-Earning Family

Meet Alex and Jamie, a professional couple with a combined household income exceeding $500,000, raising two young children in a high cost-of-living area. Their high salaries mean they often max out tax-advantaged accounts like 401(k)s, but they struggle with "lifestyle creep"—the tendency for their spending to rise with their income. They're navigating complex financial goals: aggressively saving for their children's private school tuition or 529 plans, paying down a significant mortgage, and simultaneously growing a taxable brokerage account since they've surpassed other contribution limits. They feel confident in their income but lack a coordinated, long-term strategy for optimizing taxes, managing their equity compensation, and ensuring they have adequate liquidity and estate planning documents like wills and trusts in place to protect their family.

Their core challenge is transitioning from being excellent savers to becoming strategic wealth builders. Their current plan needs to focus on tax diversification (balancing pre-tax, Roth, and taxable investments), maximizing their annual backdoor Roth IRA contributions, and strategically managing their substantial cash flow beyond basic retirement accounts. A key step would be establishing a "money meeting" cadence to align on their financial values and set clear measurable goals for major expenses, income tax reduction and saving buckets.

Meet Sarah, the successful owner of a high-growth law firm structured as a pass-through entity (like an S-Corp or LLC), whose substantial annual net income places her firmly in the highest federal and state income tax brackets. Unlike an employee, Sarah faces a double burden: the steep marginal income tax rate on her profits plus the entire self-employment tax of 15.3% (for Social Security and Medicare), which she has to pay herself as both the 'employer' and 'employee' portion. This combined tax obligation—often paid via large, quarterly estimated tax payments—creates enormous pressure on her cash flow and makes it feel like a huge portion of her hard-earned success is constantly being diverted to the government.

Her immediate goal isn't necessarily to earn more, but to keep more of what she already earns by reducing her effective tax rate. This requires constant, proactive tax planning beyond simply maximizing business deductions. Strategies like utilizing a 401(k) or Defined Benefit Plan to make massive tax-deductible retirement contributions, leveraging the Qualified Business Income (QBI) Deduction, and considering a restructure to an S-Corp to reduce the portion of income subject to self-employment tax. For Sarah, the tax code feels like a complex, heavy machine she must perpetually navigate just to maintain her current financial standing.

Tax Challenges for the High-Income

Business Owner

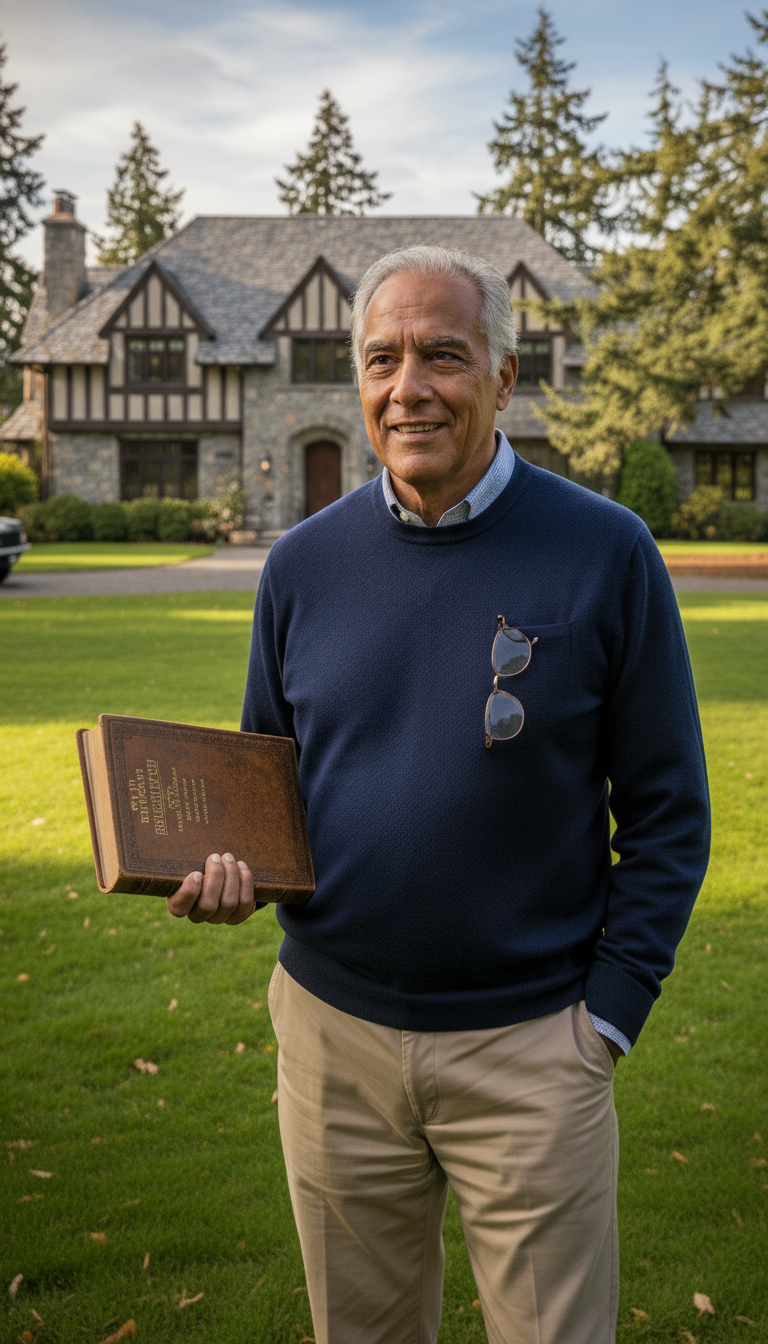

A Legacy to Defy Estate Tax

Meet Mr. Harrison, a recently retired entrepreneur in Washington State with a net worth comfortably exceeding $30 million, who is keenly aware of the compounding threat of estate taxes. As a Washington resident, his estate is subject to one of the most aggressive state estate taxes, which kicks in at a low threshold of $3+ million and climbs to a high marginal rate of up to 35% on the largest estates. Crucially, his wealth also pushes him far above the federal estate tax exemption (currently around $13.99 million per person in 2025), meaning his heirs face a potential combined tax rate exceeding 50% on his multi-million-dollar taxable estate. His primary concern is not just minimizing this tax burden, but strategically transferring assets to his children and grandchildren to secure their financial futures and fulfill his charitable vision without simply handing over a massive tax bill.

To secure his legacy and make a difference, Mr. Harrison needs sophisticated, irrevocable wealth transfer strategies immediately. His plan involves implementing a Dynasty Trust to hold assets for his grandchildren across generations, shielded from estate tax. To blend his family's needs with his philanthropy, he's exploring a Charitable Remainder Trust (CRT): he can transfer highly appreciated assets to the CRT, receive an immediate income tax deduction, generate income for his retirement, and—most importantly—have the remainder pass to his favorite causes, ensuring his charity inclination is fulfilled while simultaneously removing significant assets from his taxable estate. By taking these steps, he transforms potential tax dollars into enduring wealth and powerful charitable contributions.

After decades of dedicated work at Starbucks, the Seattle-based company, Mark and Susan are retiring. Their retirement savings are substantial, largely thanks to years of consistent 401(k) contributions and a major portion of that money being heavily invested in highly-appreciated SBUX company stock. Now, facing the reality of drawing down their nest egg, they are gripped by anxiety. Their portfolio is overwhelmingly concentrated in one stock—a risk they accepted while working but find terrifying as retirees who need a reliable income stream. They know they must rebalance out of the stock to mitigate sequence-of-returns risk and avoid a catastrophic single-stock downturn, but the sheer size of their potential tax bill on that deferred growth in their 401(k) makes them hesitate.

Their first critical financial decision revolves around using the Net Unrealized Appreciation (NUA) tax strategy for their SBUX stock. If they execute a lump-sum distribution, they can move the stock in-kind to a taxable brokerage account, pay ordinary income tax only on the original, low cost-basis, and have the massive stock appreciation (the NUA) taxed at the lower long-term capital gains rate only when they eventually sell it. For the non-stock portion of their 401(k), they'll roll it into an IRA. This complex maneuver is the key to minimizing their tax leakage. Once complete, their focus shifts to a comprehensive withdrawal strategy, likely a "bucket" approach, to manage risk, preserve capital, and ensure their savings last well past their Required Minimum Distribution (RMD) age.